Mileage Log Form Driver For Mac

Search 'Trip Miles Plus' to find the app. Beautiful and easy to use mileage tracker for reimbursement or IRS. It allows you to email the mileage log and expenses of your trips as a tabular report. To find out your business tax deduction amount, multiply your business miles driven by the IRS mileage deduction rate. Let’s say you drove 15,000 miles for business in 2019. Multiply 15,000 by the mileage deduction rate of 58 cents (15,000 X $0.58). You could claim $8,700 for the year using the standard mileage rate method.

Standard mileage methodUse the standard mileage method to calculate the amount of business mileage you can claim on your tax return. Just multiply your total business miles for the year by the standard mileage rate.If you want to use the standard mileage method, you have to do so for the first year that you drive for work. Afterwards, you can choose between the standard mileage method and the actual expenses method. Keep in mind that if you choose the standard mileage method, you can’t deduct any other vehicle expenses. Actual expenses methodThe actual expenses method is more complex, but it may result in a bigger tax deduction for you. With this method, you can deduct vehicle-related costs if at least some of your driving is for business purposes.The IRS requires that you substantiate your expenses with documentation, such as receipts, work orders, or other written records.

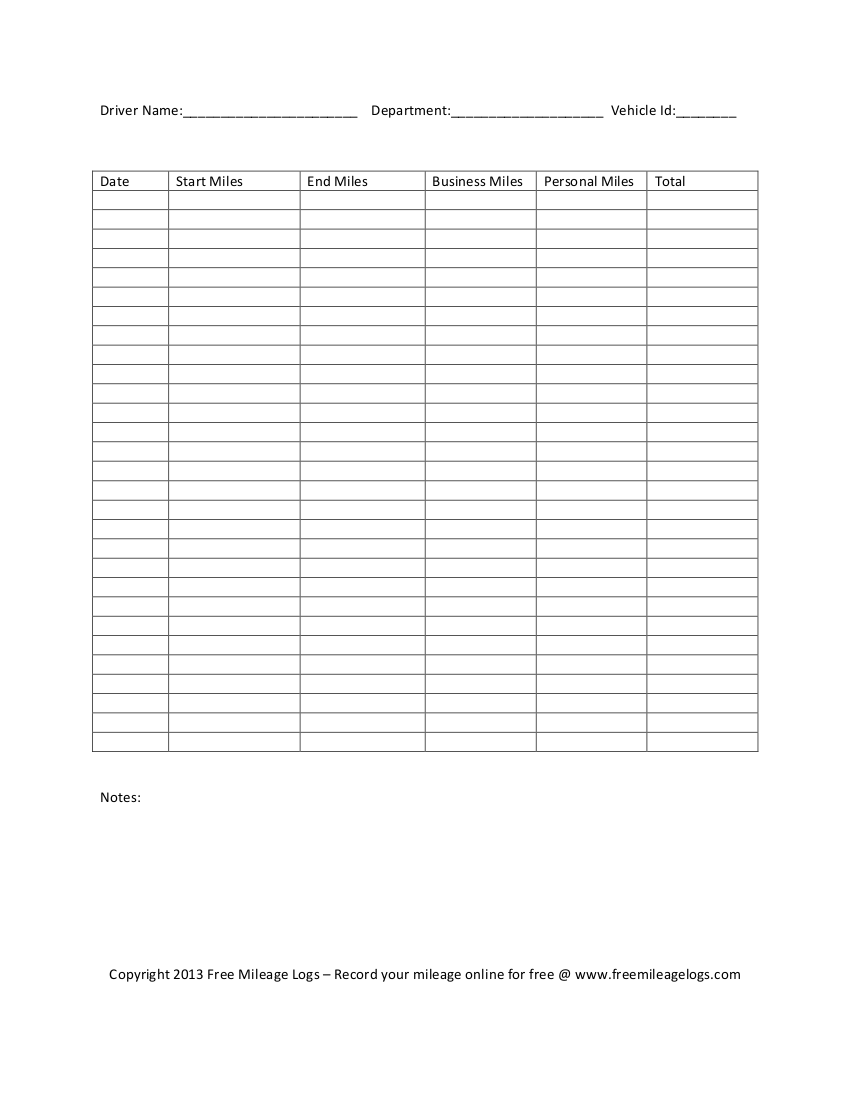

For each expense, be sure to record the expense amount, expense date, place of service/purchase, and description, such as oil change, tire rotation, or lease payment. A mileage log is a written record of your trips that you submit with your business mileage deductions.

It should show the date, destination, business reason for the trip, odometer readings, and total mileage. If you drive your vehicle for both personal and business use, you can only deduct the mileage that qualifies as business-related.The IRS requires that you keep your mileage logs for three years—whether a paper-and-pencil mileage log you keep in your glove box or a digital mileage log stored on your phone.As the taxpayer, it’s your responsibility to document all business mileage claimed, and to report it accurately when filing taxes. If you’re audited, the IRS will look for documentation to substantiate that mileage was in fact business-related. Without such documentation in the event of an audit, the IRS could disallow your deductions, costing you far more than the hassle of jotting down notes about your trip. A mileage log is a written record of your trips that you submit with your business mileage deductions. It should show the date, destination, business reason for the trip, odometer readings, and total mileage. If you drive your vehicle for both personal and business use, you can only deduct the mileage that qualifies as business-related.The IRS requires that you keep your mileage logs for three years—whether a paper-and-pencil mileage log you keep in your glove box or a digital mileage log stored on your phone.As the taxpayer, it’s your responsibility to document all business mileage claimed, and to report it accurately when filing taxes.

I most likely will draw in Sketchbook Pro and then edit it in Photoshop, because PS has so many editing tools available, but I will spend most of my time drawing in Sketchbook Pro since it's way easier to manipulate. Mac software.

If you’re audited, the IRS will look for documentation to substantiate that mileage was in fact business-related. Without such documentation in the event of an audit, the IRS could disallow your deductions, costing you far more than the hassle of jotting down notes about your trip. When you have an employer that requires you use your vehicle to conduct business—such as running errands, meeting with a client, or traveling to the airport for a business trip—you can track your miles and get reimbursed for those miles by your employer.Employers can use the IRS standard mileage rate to reimburse their employees for business mileage. If your employer doesn’t reimburse for business mileage, or doesn’t reimburse the full amount determined by the IRS, then you can claim the amount of business mileage that was not reimbursed on your personal tax return.Self-employed workers are their own employers and so there is no mileage reimbursement. Instead, you need to track and calculate your business mileage deduction to claim at tax time.

When you have an employer that requires you use your vehicle to conduct business—such as running errands, meeting with a client, or traveling to the airport for a business trip—you can track your miles and get reimbursed for those miles by your employer.Employers can use the IRS standard mileage rate to reimburse their employees for business mileage. If your employer doesn’t reimburse for business mileage, or doesn’t reimburse the full amount determined by the IRS, then you can claim the amount of business mileage that was not reimbursed on your personal tax return.Self-employed workers are their own employers and so there is no mileage reimbursement.

Instead, you need to track and calculate your business mileage deduction to claim at tax time. Swipe left for business milesAfter you finish driving, you need to sort your business miles from personal. With QuickBooks Self-Employed, simply swipe right to categorize a trip as personal or swipe left to put it in a business mileage category.Using a mileage tracking app like QuickBooks Self- Employed ensures that your business mileage is recorded and organized so that it’s not lost or forgotten when you need it. At tax time, you have all the details necessary to claim your mileage deduction. Swipe left forbusiness milesAfter you finish driving, you need to sort your businessmiles from personal.

With QuickBooks Self-Employed,simply swipe right to categorize a trip as personal orswipe left to put it in a business mileage category.Using a mileage tracking app like QuickBooks Self-Employed ensures that your business mileage isrecorded and organized so that it’s not lost or forgottenwhen you need it. At tax time, you have all the detailsnecessary to claim your mileage deduction. Based on QuickBooks Self Employed tax year 2015 subscribers that have identified $0 in business expenses and of those users that have $0 in tax savings and have logged between 0 and $0 in income and $0 in business expenses. Beginning on Jan. 1, 2019, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 58 cents per mile for business miles driven, up from 54.5 cents for 2018. 20 cents per mile driven for medical or moving purposes, up from 18 cents for 2018. 14 cents per mile driven in service of charitable organizations, unchanged from 2018.

These and other requirements are described in Rev. Notice 2016-79, posted today on IRS.gov. Based on TY17 US mobile subscribers that have identified $0 in income and $0 in business expenses. Based on TY17 US mobile subscribers that have identified $0 in income and $0 in business expenses.Terms, conditions, pricing, special features, and service and support options subject to change without notice.